Still undecided about which payroll service provider is included in the best payroll companies? With our list of the best payroll companies service providers for small businesses, we break down your alternatives. We may be compensated by partners and advertisers whose products are featured on this site.

Although compensation may influence where products appear on our site, editorial opinions, scores, and reviews are never influenced by advertisers or partners. Paying your staff is one of the most crucial jobs you’ll have as a small business owner. Payroll may be a daunting chore, especially for new business owners who are paying employees for the first time and are unsure how payroll works.

The most common reason for businesses to use the best payroll companies is to guarantee that payroll taxes are correctly withheld, tax forms are filled out correctly and promptly, and taxes are sent to the relevant agency on time. The best payroll companies, on the other hand, can help with a variety of other tasks.

They enable direct deposit for your employees, track personal information such as start and termination dates, hourly and salaried wages, and, in many cases, interface with accounting software packages to make tracking payroll expenses easier.

10 Best Payroll Companies For Online Payroll Services

When it comes to hiring the best payroll companies, small business owners have a lot of options. While the majority of the payroll software examined provides online payroll services, there are a couple that provides an on-premise solution, including one that is completely free. The following are our top ten best payroll companies.

QuickBooks Online Payroll

QuickBooks Online Payroll is a standalone payroll software solution that may be used in conjunction with QuickBooks Online Accounting. QuickBooks Online Payroll can be used for up to 50 employees due to varying pricing levels; however, due to varying pricing levels, it is most cost-effective for organizations with 15 or fewer employees. Quickly get up and running with QuickBooks Online Payroll’s simple onboarding procedure. This company is included in the best payroll companies in 2022. All of the application’s plans include unlimited payroll runs, direct deposit, and tax reporting and remittance.

Your employees can also obtain pay stubs and tax forms through an employee portal. Every package comes with a mobile app for iOS and Android smartphones. HR capabilities are accessible in QuickBooks Online Payroll but only in the Premium and Elite plans. Both designs have the capacity to track time. QuickBooks Online Payroll costs $22.50 per month, $37.50 per month for the Premium plan, and $62.50 per month for the Elite plan. For the first three months, all pricing includes a 50% reduction, with a $4 per employee fee applied to the base price.

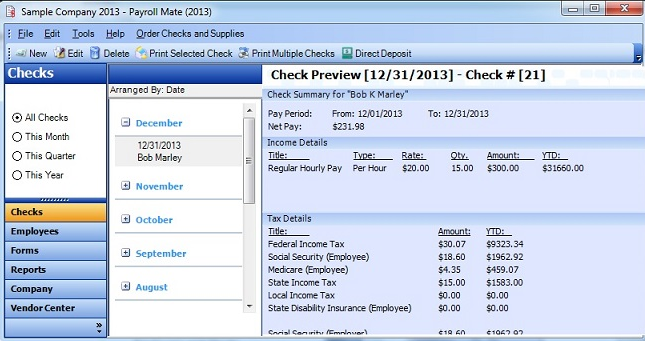

Payroll Mate

Real Business Solutions’ Payroll Mate is a low-cost payroll program that is excellent for small firms that desire an on-premise solution. Payroll Mate is solely compatible with Windows operating systems and does not provide online access, though it can be hosted on a remote server if necessary. Payroll Mate is a suitable alternative for accountants who conduct payroll for their customers and is geared for organizations with fewer than 75 employees.

Payroll Mate enables different pay intervals, unlimited payroll runs, and multistate payroll, making it a good solution for small firms with several locations. Payroll Mate is best for folks who are comfortable filing their own tax returns. The application costs $139 per year and includes all associated tax tables, whereas the Direct Deposit module costs $95 per year.

Patriot Payroll

Patriot Payroll isn’t as well-known as some of the other payroll apps mentioned here, but it has a lot of the same functions. Patriot Payroll is a small business payroll service that presently has two options available, both of which include free direct deposit, an employee portal, and a free payroll setup. Remember that the basic plan does not include tax preparation or remittance. Patriot Payroll has a simple, clear interface, and the price covers the full program setup.

There is no need for a mobile app because the program works on any device. For convenient tracking of employee PTO, the application also features an outstanding accrual rule option. Patriot Payroll has two plans: Basic, which costs $10 per month, and Full-Service, which costs $30 per month and includes a $4 per employee fee. The add-on Time and Attendance module cost $5 per month, and the Human Resources module costs $4 per month, both with a $1 per employee fee.

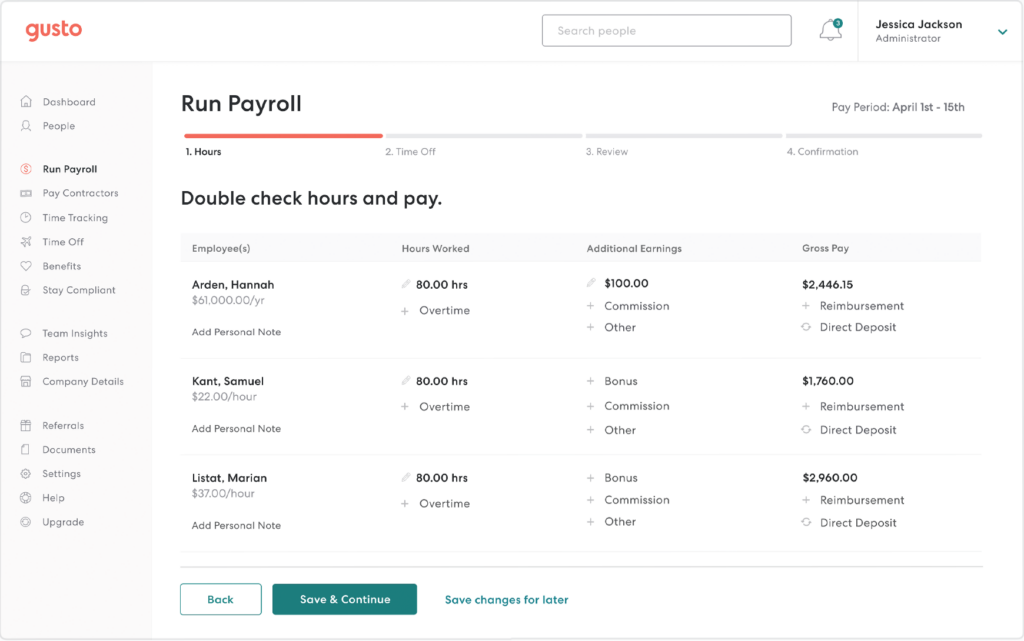

Gusto Payroll

Gusto was created for small businesses, and it’s especially well-suited to those in the hospitality sector, with features and resources that make keeping track of different income levels and tip amounts a breeze. Gusto also helps new users get up and running quickly by assisting them with the first payroll setup procedure. Gusto includes new-hire reporting, customizable payroll schedules, limitless payroll runs, contractor payments, and multistate payroll capability, among other features.

Gusto may be accessed from any device, thus there is no need for a mobile app. Gusto’s Basic plan costs $19 per month plus a $6 per-employee fee; the Core plan costs $39 per month plus a $6 per-employee fee; Complete costs $39 per month plus a $12 per-employee fee; and Concierge costs $149 per month plus a $12 per-employee fee. This company is included in the best payroll companies in 2022.

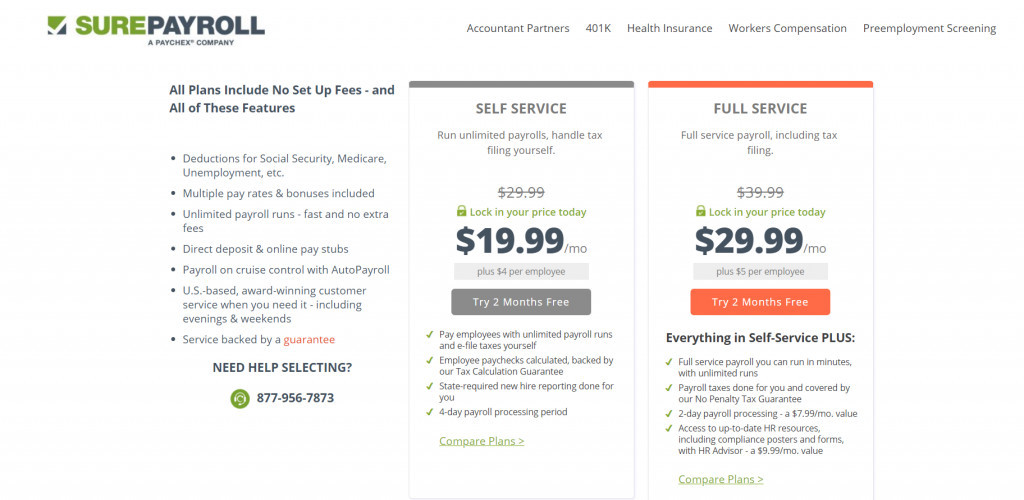

SurePayroll

SurePayroll is a payroll software for small businesses that includes a version specifically for paying domestic workers. SurePayroll has worked to automate the entire payroll process, which is a big benefit for already overworked business owners. It is best for small firms with 10 employees or less. Direct deposit, new-employee reporting, and time and attendance tracking are all available with SurePayroll. This company is included in the best payroll companies in 2022.

With a mobile app for both iOS and Android smartphones, the program also features complete tax reporting and remittance. SurePayroll also has an employee self-service option and interfaces with a wide range of third-party applications. Self-Service costs $19.99 per month plus $4 per employee, while Full-Service costs $29.99 per month plus $5 per employee.

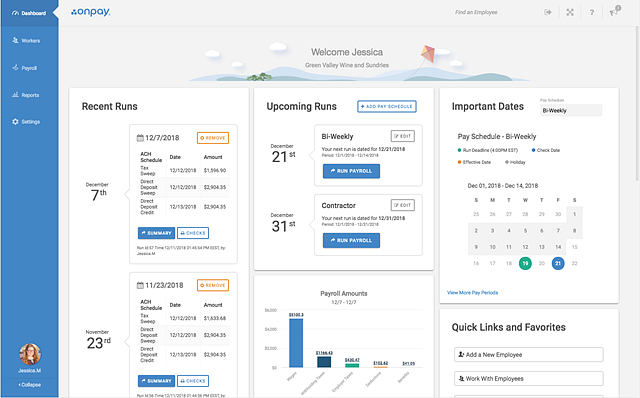

OnPay

OnPay, despite being developed for small enterprises, can easily grow to meet the needs of mid-sized businesses. OnPay enables restaurants and other businesses that need to account for employee tips with industry-specific functionality and easy system navigation. Employee onboarding and self-service are also included in OnPay’s subscription, as well as unlimited payroll runs, comprehensive mobile accessibility from any device, direct deposit, and multistate payroll capability.

There is no need for a separate mobile app because the application is built to work on any platform and effortlessly pays both workers and contractors, issuing both W-2s and 1099s at the end of the year. This company is included in the best payroll companies in 2022.

OnPay provides extensive HR resources, including employee offer letters, PTO approvals, compliance tools, and a selection of HR templates that may be utilized in a variety of situations, in addition, to completing payroll processing. OnPay’s support team is trained by the American Payroll Association and offers good integration possibilities with a variety of third-party accounting and timesheet/timekeeping software.

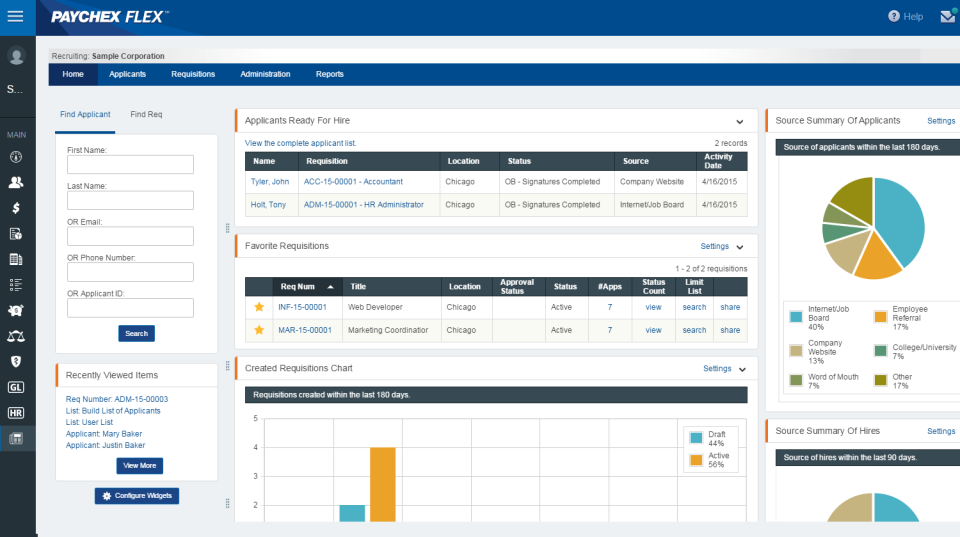

Paychex Flex

Paychex Flex has three options to select from Paychex Go, which is for businesses with up to ten employees; Select, which is for organizations with ten to 49 employees; and Enterprise, which is for enterprises with more than 49 employees. New-hire reporting, 24/7 assistance, automatic employment, and income verification, pay cards, and multistate payroll functionality are all included in all plans, as well as complete tax reporting and remittance.

The user dashboard in Paychex Flex allows for easy system navigation by displaying current payroll information and providing quick access to system functions. Pay stubs, tax forms, and vacation and sick balances can all be accessed through the software’s employee interface, which also includes a direct deposit. At Paychex, W-2s and 1099s are processed for a cost, and other features like a Workers’ Compensation report, General Ledger Service, and State Unemployment Insurance are only accessible in the higher-priced Paychex Flex plans.

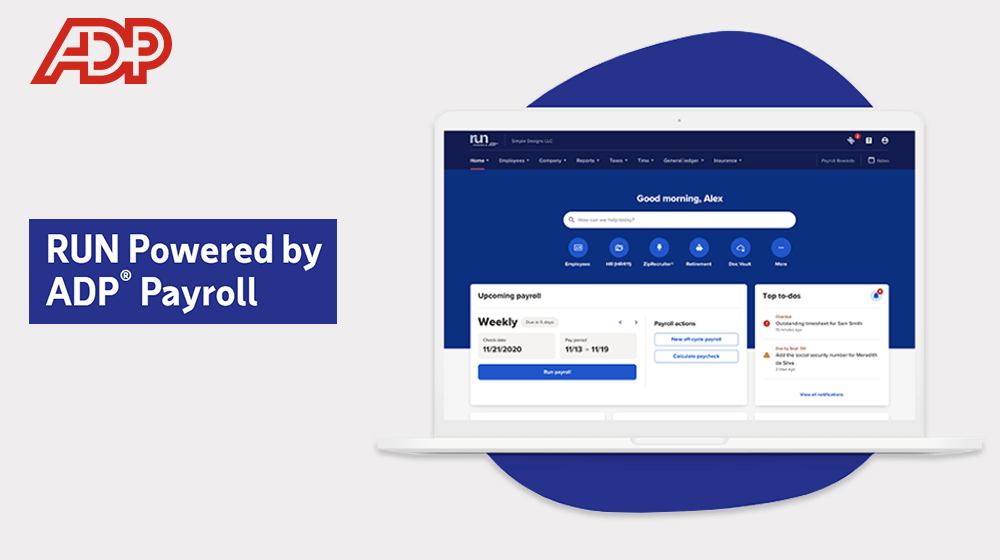

RUN Powered by ADP

ADP is the driving force behind this project. ADP, perhaps the most well-known name in payroll, has released several programs aimed at small businesses. Run Powered by ADP, which is geared for organizations with 49 or fewer employees, is one of their most popular applications. Run Powered by ADP has four plans, with the top two including many of the more powerful features. Although a mobile app for iOS and Android smartphones is available, it is not included in the base pricing. All options include free direct deposit, onboarding for new employees, and the ability to pay contractors. In addition, all plans include tax reporting and remittance.

Powered by ADP, they also provide HR resources, but only for their most expensive programs. ADP is hesitant to provide pricing information for its payroll programs, preferring instead to chat with business owners about the plans and services available. However, depending on the plan and other services acquired, the cost for a company with 10 employees would likely start at around $150-$180 per month.

Payroll4Free

Payroll4Free is a payroll processing service for small enterprises with fewer than 25 employees. While the free version of Payroll4Free does not include tax filing and remittance, you can upgrade for a modest price to include tax reporting and remittance. Payroll4Free contains significant features such as direct deposit capability and a grid entry option to speed up the process of entering payroll-related data, despite the fact that the basic application is free. This company is included in the best payroll companies in 2022.

Paycor

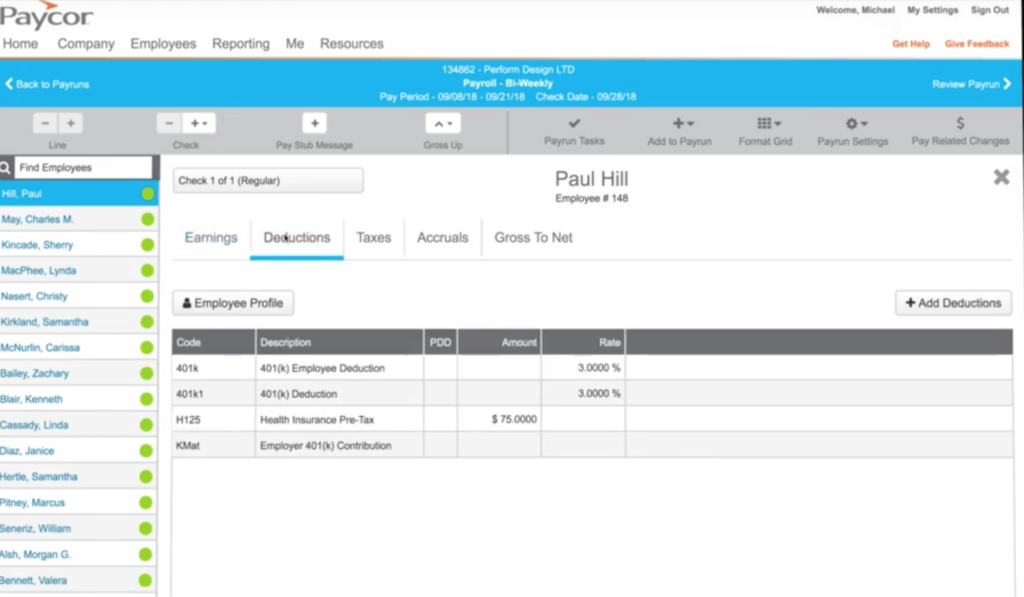

Paycor caters to small and mid-sized organizations, with a payroll solution tailored to companies with fewer than ten employees. Paycor provides a comprehensive set of payroll services, including direct deposit, employee self-service, and the ability to pay contractors. Paycor provides a mobile app for both iOS and Android devices, as well as complete tax filing and remittance.

Paycor’s top two plans include HR resources, and the most expensive plan includes an onboarding tool. Paycor provides simple, straightforward navigation and handles the entire initial system setting. You may enter payroll data quickly using a pay grid, and you can pay your employees via direct transfer, pay card, or check. Paycor offers packages for small businesses (one to 39 employees) and mid-market businesses (40+ employees). This company is included in the best payroll companies in 2022.

The Small Business bundle includes three payroll plans: Basic, which starts at $99 per month for up to ten employees; Essential, which starts at $149 per month for up to ten employees and includes HR capability and employee garnishment options; and Complete, which starts at $199 per month and includes HR templates, employee onboarding, and integration with third-party accounting apps.

Conclusion

Why not use a payroll service that streamlines the entire payroll process instead of battling with manual systems to figure out how to perform payroll? There are multiple excellent best payroll companies available.