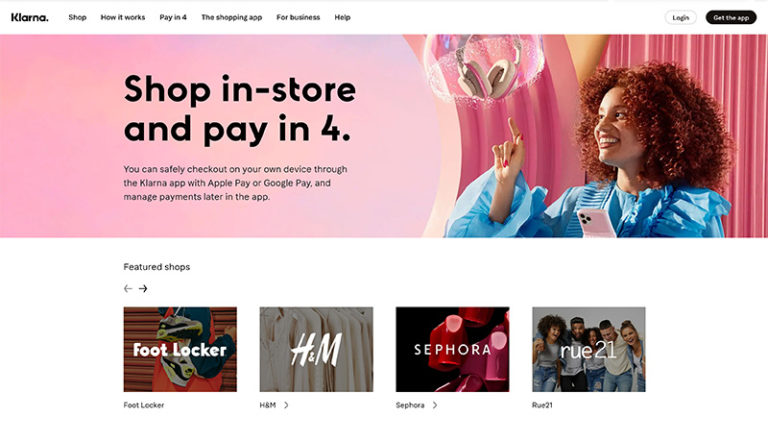

Klarna is a prominent Swedish fintech firm, has positioned itself as a dominant entity within the rapidly expanding purchase now, pay later (BNPL) sector. Klarna collaborates with more than 500,000 businesses and executes 2 million transactions per day on behalf of its 150 million users in 45 countries. Among these corporations are well-known brands like Nike, Adidas, and IKEA. Klarna’s substantial market share in Europe—70% in 2022—reinforces its status as the foremost provider of BNPL in the region. In this article, you will read about Klarna Login.

The offerings of Klarna accommodate a wide range of consumer requirements. Customers can divide payments into four interest-free installments over six weeks with Pay in 4, the company’s flagship product. There is a 30-day grace period for the final payment, interest-free and fee-free, under the Pay in 30 payment plan. Klarna offers financing options with competitive interest rates that start at 7.99% for larger purchases. In addition, Klarna Login provides a virtual card that enables users to access the service even in cases where businesses do not implement it directly.

What is Klarna?

Klarna founded in Sweden, has established itself as an international frontrunner in the realm of e-commerce and online payments. Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson founded the company Klarna in 2005, and by emphasizing adaptability, convenience, and a seamless user experience, they have revolutionized the purchasing process.

What is the Klarna login process?

To establish a Klarna Login account:

- Launch the Klarna application or navigate to Private Klarna Login.

- Provide the phone number or email address associated with your Klarna purchases.

- Click Confirm, then click Proceed.

- You will be notified via text message or email containing a log-in link and a six-digit verification code.

- To log in, either open the login link on the same device or enter the code into the application.

It is noteworthy that upon your initial login to Klarna Login, you will be obligated to provide verification for both your email address and phone number. You are then able to select your preferred login method.

- To activate Face ID, Touch ID, or PIN code verification,

- Navigate to the Settings

- Tap and choose Touch ID, Face ID, and PIN.

- Enable Face ID, Touch ID, or PIN and finish the configuration procedure.

Klarna is a corporation that provides Ticketmaster customers with adaptable online payment alternatives via Klarna Financing. For further information regarding Klarna, please visit klarna.com.

How is Klarna implemented?

Customers can utilize Klarna as their preferred payment method during the purchasing process, which can occur on an e-commerce platform, mobile application, or brick-and-mortar retail location. Through the Klarna app, customers can monitor orders, view payment schedules, make payments, and contact customer service, in addition to managing their Klarna accounts. Customers utilizing Klarna have the option to select from the subsequent payment plans:

- This alternative allows the purchase price to be paid in four interest-free installments. The first payment is required at the time of purchase, with the remaining three payments due over the next six weeks.

- This alternative provides purchasers with thirty days to remit the complete amount of their purchase, with no accrual of interest or charges if paid promptly.

- Long-term loans: Letter-term loans can be utilized to finance larger purchases. The initial interest rate on this option is 7.99%.

A limited selection of products qualify for financing via Klarna Login. As an illustration, Klarna does not provide financing options for intangible commodities like music, e-books, and movies, as well as services like car repairs, manicures, and legal fees. It will also finance investments, insurance, tickets, and event passes, among other financial products. Additionally, alcohol, tobacco, firearms, and explicit content are prohibited from being financed via Klarna.

With certain restrictions, the following product categories are generally eligible for Klarna financing:

- Klarna generally extends financing options for a wide range of physical products, such as appliances, apparel, electronics, furniture, and household goods.

- Certain digital products may qualify for Klarna financing, including memberships, online courses, and software licenses.

- To reserve flights, hotels, and vacation packages through particular travel partners, Klarna provides financing options.

- Certain gift cards may qualify for Klarna Login financing; however, eligibility may be subject to restrictions that vary by issuer and gift card type.

- Preorders: Klarna may offer financing for preorders of specific products; however, the repayment schedule may deviate from conventional financing alternatives.

- Personalized or custom-made items: The eligibility requirements for personalized or custom-made items vary by product and business.

Who makes use of Klarna?

Klarna operates in 45 global markets and integrates with an extensive variety of business models, catering to a diverse clientele. The diverse demographics of Klarna users—education, age, life stage, and community—illustrate the service’s extensive appeal among numerous consumer segments. Customers of Klarna utilize the service for bill payments, in-app purchases, online purchases, and in-store transactions. The most recent demographic information regarding Klarna Login clientele is detailed below:

- Gender: Klarna reports that forty percent of its clientele are men and sixty percent are women.

- Klarna’s disclosure that 31% of its clientele possess a university degree underscores the service’s accessibility to individuals from diverse educational backgrounds.

- 36% of Klarna customers are partnered with children, 27% are single without children, 18% are partnered without children, and 11% are single with children, according to Klarna Login data.

- According to Klarna’s data, 40% of its consumers reside in cities, 32% in suburban areas, and 28% in rural regions.

The following are the sectors in which Klarna has achieved the most success:

- Numerous significant retailers accept Klarna as a method of payment, and the apparel, electronics, and furniture industries are experiencing the most rapid adoption rates.

- The integration of Klarna by airlines and travel reserving platforms, such as Expedia, enables passengers to make reservations for hotels and flights using adaptable payment methods.

- Dental offices, pharmacies, and wellness-focused businesses have all adopted Klarna, increasing access to services for people who might not have the financial means to pay in full upfront.

- Automobile care establishments also accept Klarna Login as a practical method of payment for tires and other necessary items.

Transacting with Klarna

Which methods of payment does Klarna accept?

Presently, most debit and credit cards (Mastercard, Visa, Discover, and American Express) are accepted at Klarna. Prepaid credit cards are not recognized at this time.

How can I determine whether Klarna has received my payment?

For all completed payments, Klarna Login will send email confirmations. Additionally, you can confirm payment via live chat with Klarna’s customer service agents or by calling 1-844-4KLARNA (1-844-455-2762).

Is it possible to settle my balance before the due date?

To expedite the payment of the subsequent installment or the entire balance of your payment plan, log into the Klarna application, navigate to the Purchases page, and choose the Payment Options option.

What occurs if the order is not paid for in full?

Klarna will endeavor to collect payment for your purchase automatically from the card information you provided during checkout. By accessing your Klarna account or the email you received at the time of purchase, you can ascertain the exact date and time of payment collection.

To request an extension on the payment process, log into the Klarna Login application, navigate to the Purchases page, and choose Payment Options. If prompted, choose “Extend due date.”

Significant Aspects

Order Administration:

Order administration efficiency is critical to the success of any organization, and with Klarna’s platform, you can enjoy a streamlined procedure that includes real-time updates on every order. This enables you to remain apprised throughout the entire process, from order placement to fulfillment, thereby facilitating the provision of accurate and timely information to your clientele. The intuitive and user-friendly interface of the platform facilitates the efficient management of transactions, thereby enhancing the overall consumer experience.

Statements of Settlement:

Klarna provides comprehensive settlement reports that are customized to your organization’s particular requirements. These reports provide valuable insights into financial transactions, thereby simplifying the processes of reconciliation and financial monitoring. You can gain a comprehensive comprehension of your financial performance and expedite your accounting processes by customizing settlement reports. This will enable you to make more informed decisions.

Divergences of opinion:

Managing client disputes can present a formidable obstacle to the operation of an online store. The consolidation of all customer disputes into a single location by Klarna Login streamlines this process. This functionality enables you to address and resolve consumer concerns expediently, ensuring that disputes are effectively and promptly managed. The establishment of a designated area for the resolution of disputes can effectively preserve customer confidence and contentment.

Stripe Integration Capabilities:

For enterprises that employ Stripe as their payment gateway, Klarna offers a streamlined integration solution that enables the incorporation of Klarna payments into any Stripe integration. This integration expands the range of payment alternatives available to consumers, granting them the autonomy to select Klarna’s payment solutions. Consistent with a variety of business models, including e-commerce and subscription-based services, Klarna’s integration with Stripe provides a flexible solution.

Assembling Adyen:

Comparable to its integration with Stripe, Klarna provides Adyen, an additional well-known payment service provider, compatibility. This integration enables the incorporation of Klarna Login payments into any Adyen integration type. By incorporating Klarna’s payment options into your platform, you can accommodate a wider range of consumers and offer them a more convenient and all-encompassing retail experience.

The integration of Shopify:

Klarna integrates seamlessly with Shopify, enabling businesses utilizing Shopify as their e-commerce platform to incorporate Klarna payments into any Shopify integration. The purpose of this integration is to augment the purchasing process for users of Shopify by providing an additional choice in the form of Klarna’s adaptable payment solutions. Using this integration, one can utilize the functionalities of Klarna while remaining within the Shopify environment, thereby establishing a unified and intuitive purchasing journey for clientele.

Describe Pay in 4 and explain how it operates

Customers can spread out the cost of their purchase over time by using Klarna’s Pay in 4 service, which divides it into four interest-free installments.

At checkout, if your cart is eligible for Pay in 4, you will have the option to select Klarna Login as your payment method. When the order is dispatched or received, the initial payment will be deducted from the card. Every two weeks, the remaining balances will be automatically charged to your card. You will receive updates regarding upcoming payments. Payments made punctually are exempt from interest and fees. For further information, please visit klarna.com.

How do I become a Pay in 4 Participant?

If your cart satisfies the following criteria and is eligible, you may choose Klarna Login during the transaction process. To register, you will require:

- An American-issued credit or debit card,

- To be at least 18 years of age,

- A phone number capable of SMS transmission and

- A residential address in the U.S.

Is a credit check mandatory for Pay in 4, and if so, how will it affect my credit score?

When you sign up for Pay in 4, Klarna may run a soft credit check, but it won’t affect your credit score or show up as a hard inquiry on your credit report. Consult the FAQ page on Klarna to learn whether the company conducts credit checks.

How do I get in touch with Klarna concerning Ticketmaster Pay in 4?

Contacting Klarna is possible at any time via the Klarna Login app, at https://www.klarna.com/us/customer-service/, or by dialing 1-844-4KLARNA (1-844-455-2762).

Aspects of the Klarna Integration

Register with Klarna:

Klarna streamlines the user enrollment procedure through the provision of “Sign in with Klarna.” This functionality enables clients to effortlessly register for your platform by utilizing their Klarna account credentials. By utilizing Klarna Login as the favored method of sign-in, you augment user convenience and confidence, as patrons can employ their preferred and well-known sign-in alternative.

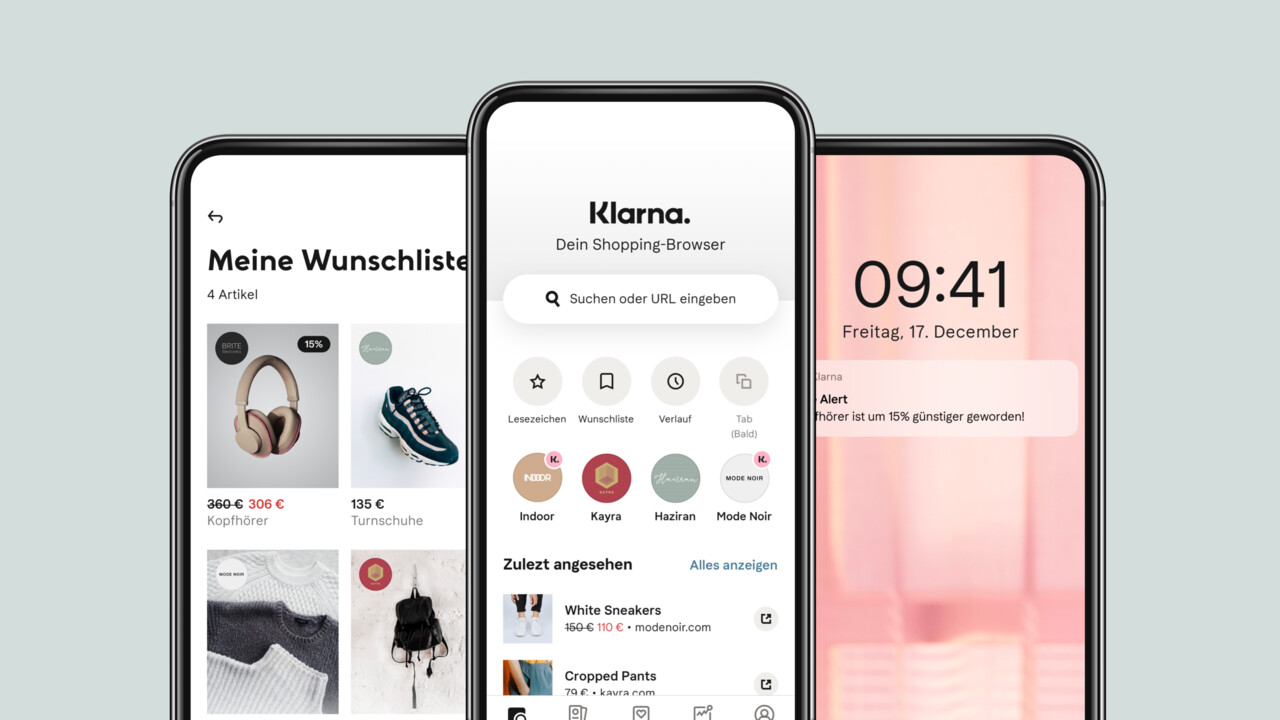

In-App Wallet Transactions:

Improve the user experience of your mobile application by integrating Klarna, a payment platform that enables users to conduct transactions immediately within the application. In-app payments offer consumers the convenience of completing transactions without the need to navigate to external websites, thereby guaranteeing a streamlined and unified payment process. The purpose of this functionality is to enhance the mobile purchasing experience and minimize complications throughout the payment phase.

Page for Hosted Payments:

Utilize the hosted payment page that Klarna offers to simplify the process of integrating Klarna into your platform. By facilitating the acceptance of payments via a Klarna-hosted page, this functionality enables you to streamline the payment acceptance process. By utilizing Klarna’s hosted payment page, organizations can streamline their integration processes and commence accepting Klarna Login payments with minimal development effort, thereby simplifying the integration process.

Provision of services by Klarna

Order Administration:

Klarna offers an all-encompassing order administration service that facilitates a streamlined operation for businesses by providing timely and accurate information regarding every order. This service facilitates the tracking and management of orders from the instant they are submitted until they are fulfilled efficiently for businesses. The utilization of real-time updates facilitates increased transparency, allowing organizations to furnish consumers with precise information while streamlining the order fulfillment process as a whole.

Statements of Settlement:

Enterprises can get the most out of Klarna Login’s settlement report service thanks to its customization. These reports furnish comprehensive analyses of financial transactions, thereby furnishing organizations with an unambiguous synopsis of their fiscal performance. Through the implementation of customized settlement reports, organizations can effectively synchronize transactions, monitor financial metrics, and arrive at well-informed decisions. The primary objective of this service is to facilitate the accounting process and enhance the efficiency of the financial management system.

Divergences of opinion:

Managing client disputes can present a formidable obstacle to the operation of an online store. The centralized location where all customer disputes are consolidated by Klarna’s dispute service simplifies the management and resolution of customer issues for businesses. Through the implementation of a specialized dispute resolution platform, organizations can effectively manage and rectify customer concerns, thereby guaranteeing a timely and efficient process of resolution. This service facilitates the preservation of consumer trust and contentment for organizations through the prompt resolution of disputes.

Platforms for Integrating Klarna Payments

Stripe Integration Capabilities:

The integration between Klarna and the Stripe platform is seamless, enabling organizations to incorporate Klarna Login payments into any Stripe integration. By integrating with Stripe, businesses are granted an expanded range of payment options through their payment gateway. In the realm of online commerce, subscription services, and other platforms, Klarna’s integration with Stripe offers a flexible resolution that caters to the varied requirements of organizations.

Assembling Adyen:

Klarna additionally provides integration with the well-known payment service provider Adyen. This integration permits organizations to integrate Klarna Login payments with any Adyen integration. By incorporating Klarna’s payment solutions into their offerings, organizations can accommodate a more diverse clientele and grant patrons the autonomy to select their preferred payment method. The primary objective of this integration is to optimize the purchasing process for enterprises that utilize Adyen.

The integration of Shopify:

Klarna offers a seamless integration that enables organizations utilizing Shopify as their e-commerce platform to incorporate Klarna Login payments into any Shopify integration. This integration has been specifically designed to optimize the purchasing process for Shopify customers. By integrating Klarna’s payment solutions, organizations can provide consumers with a payment process that is more adaptable and practical.

Conclusion:

Klarna emerges as a trailblazing entity within the fintech sector, revolutionizing how individuals partake in electronic commerce and fund transfers. Klarna Login has reshaped the way users experience convenience and flexibility through the implementation of its groundbreaking “Buy Now, Pay Later” model, interest-free financing options, and streamlined transaction processes. Solidified is a market leader in online payments due to its dedication to user-friendly financial solutions, extensive merchant partnerships, and global integration with prominent platforms such as Shopify and Stripe. Klarna’s influence extends beyond mere transactional convenience; it signifies a paradigmatic change in the way consumers perceive and engage with electronic commerce.

FAQs

What is the “Buy Now, Pay Later” function of Klarna?

By enabling users to make online purchases and postpone payments, Klarna’s “Buy Now, Pay Later” function provides flexibility and convenience if payments must be settled at a later time.

How does the “Slice It” function of Klarna operate?

By allowing users to divide payments into installments, the “Slice It” feature of Klarna makes it easier for customers to pay for larger purchases gradually.

Describe the Klarna Login application and the functions it provides.

By acting as a centralized center, the Klarna app enables users to monitor orders, handle payments, and discover new retailers. It optimizes the purchasing experience as a whole through the consolidation of multiple activities.

How does Klarna guarantee a streamlined purchasing process?

By integrating with online retailers, Klarna Login streamlines the purchasing process, enabling users to complete transactions without the need to create accounts or input extensive payment information.

Does Klarna charge interest on its financing options?

Klarna frequently provides interest-free financing options for designated durations, enabling customers to defer payments without incurring supplementary expenses throughout that period.

Which nation is Klarna present in?

Since the most recent information was available in January 2022, Klarna has a global presence and serves customers in numerous countries.

How does Klarna integrate with Stripe and Shopify, two prominent platforms?

Klarna’s integration with prominent e-commerce platforms, including Shopify, Stripe, and Adyen, facilitates the effortless incorporation of Klarna Login payment alternatives by businesses, thereby broadening the spectrum of payment methods accessible to customers.